Client SSD pricing to increase by up to 15% in Q2 2024, say industry analysts

But enterprise SSD buyers will have it worse.

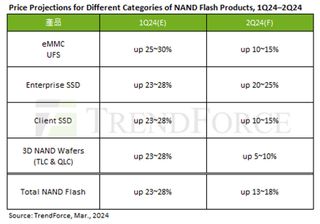

IT market intelligence firm TrendForce has published its latest price trend projections for the NAND flash market. According to its report, Q2 2024 will see further double-digit NAND flash contract price increases, compounding the increases from the previous quarter. However, client SSDs will be up a maximum of 15% in Q2, it says, which is an improvement on the 23-28% rise seen in Q1 2024.

The TrendForce chart above gives an overview and comparison of NAND Flash product price trends covering Q1 (estimate) and Q2 (forecast) this year. The table shows figures for mobile NAND-based products (eMMC and UFS), client and server SSDs, and the NAND flash wafers these products are based upon.

Q1 2024 has been pretty bad for enthusiasts looking to snap up some SSD storage on sale. Pricing across the segment has risen by 23-28% according to TrendForce research estimates, an increase that could add $100s to your PC build or upgrade plans.

Prices aren’t going to settle or go into reverse during Q2 2024, says TrendForce. Instead, we could see a further 10-15% of compounded price increases from now until the end of June.

You will notice from the chart that the client SSD price increase is outpacing that of the key 3D NAND wafers. TrendForce explains that the SSD prices have been negatively impacted by factors such as SSD maker buying strategies, a decline in associated product sales, and a lack of stockpiling in recent months.

Turning to an influence on client SSD pricing and the market as a whole, TrendForce asserts that Kioxia and WDC have boosted their production capacity utilization rates from Q1. However, other major players have been conservative with production strategies.

Things could have been worse for client SSDs. Enterprise customers will face the worst Q2 2024 price increases, according to the predictions of TrendForce analysts. The reasons behind the projected 20-25% increase in enterprise SSD prices in the current quarter are varied. The main contributors to the increases are thought to be the continued strong demand from US and Chinese communications service providers, unfulfilled demand for large-capacity products, and expectations that some will try and build inventory in Q2.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Buyers of eMMC and UFS storage products will see a similar 10-15% compounded price increase in Q2, according to the research.

Mark Tyson is a Freelance News Writer at Tom's Hardware US. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

Giroro We've all been through this before.Reply

Can they just start the anti-trust investigation now? Instead of waiting a year for a bunch of mysterious accidents and power outages to conveniently stop production at the companies that promised they really wanted to increase production for real.... "But onoes, gosh darn it, I guess we'll have to drastically cut production instead *shrug emoji*.

It would save everybody a lot of time. -

PEnns Reply

Indeed. It's very strange how each time SSDs become affordable, suddenly there is a confluence of events that directly lead to sky high prices again - and giddily happy CEOs of SSD companies!Giroro said:We've all been through this before.

Can they just start the anti-trust investigation now? Instead of waiting a year for a bunch of mysterious accidents and power outages to conveniently stop production at the companies that promised they really wanted to increase production for real.... "But onoes, gosh darn it, I guess we'll have to drastically cut production instead *shrug emoji*.

It would save everybody a lot of time. -

Notton Reply

Which even are you talking about?PEnns said:Indeed. It's very strange how each time SSDs become affordable, suddenly there is a confluence of events that directly lead to sky high prices again - and giddily happy CEOs of SSD companies!

AFAIK, there wasn't any notable event.

The NAND makers were overproducing and so they cut back production at roughly the same time.

As a company, you would have to be insane to keep producing at cost. -

thisisaname Prices going up but only a short while ago they where going down due to over supply. Demand as picked up that much already?Reply -

thisisaname Reply

They all did, one company did not cut production so they could reap the rewards of a high price and have more to sell.Notton said:Which even are you talking about?

AFAIK, there wasn't any notable event.

The NAND makers were overproducing and so they cut back production at roughly the same time.

As a company, you would have to be insane to keep producing at cost. -

Co BIY 15% hardly seems high given general inflation.Reply

Have you seen the price of every other product in the world?

Intel dumped this market because it was commodifying and tight margins are expected in the future. -

magbarn It's definitely an OPEC style cartel. Just did a spot check on SSDs and if you're overlooking the cheap Chinese branded SSDs, we're almost to double prices compares to just 6 months ago for SSDs. That's well over "inflation".Reply -

_Shatta_AD_ Everyone here supporting the US’s anti-competitive policies of sanctioning YMTC and limiting foreign NAND fab production in China, then complaining when ssd prices go up… can’t have your cake and eat it tooReply

Most Popular